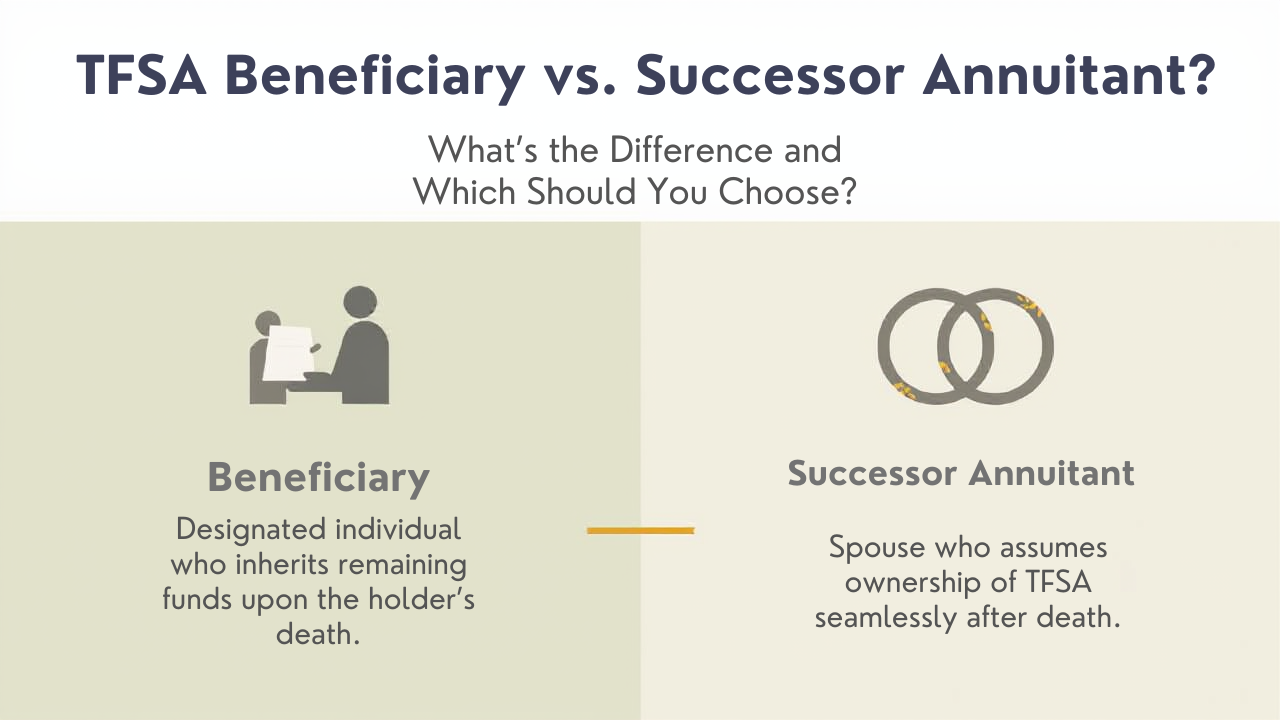

TFSA Beneficiary vs. Successor Annuitant (Holder): Which is best for you?

January 22, 2026

Learn the key differences between naming a TFSA beneficiary and a successor annuitant. Discover why the successor annuitant option is best for spouses and how to choose the right designation for your financial plan.

Navigating January Blues and the Holiday Debt Hangover

Jan 15, 2026

Why do money worries peak in January? Explore the fears behind financial anxiety, and learn how planning can turn stress into confidence.

Understanding Risk Management in Your Financial Plan

December 12, 2025

We’re discussing risk management in financial planning: insurance strategies, protecting assets, and provision-focused planning for Canadian families and businesses.

Financial Planning for Business Owners: Beyond the Bottom Line

December 12, 2015

Financial planning for business owners in Canada: Integrate corporate and personal finances with Life-Centred Planning for sustainable wealth and security.

Wealth Transfer Planning in Canada: Beyond Traditional Estate Planning

November 4, 2025

Wealth transfer planning goes far beyond estate documents. Learn the six key decisions that prepare the next generation for stewardship and strengthen family bonds.

How to Align Your Financial Plan With Your Life Goals

October 27, 2025

We’re unpacking how life-centred financial planning prioritizes your life goals over investment returns, helping you achieve the best life with the money you have today.

Protecting Your Financial Future in a Digital World

October 21, 2025

October is Cybersecurity Awareness Month, and as your trusted financial planning partner, we want to help you stay safe in today’s increasingly digital world. Cyber threats are evolving rapidly and protecting your personal and financial information is more important than ever.

Honesty and Generosity: The Hidden Keys to Financial Success

Tim Borody, CPA, CMA, CFP, Investment Advisor, Advice First Wealth – September 24, 2025

When people think of financial success, they often focus on skills, strategy, or hard work. While those are important, how you conduct yourself matters just as much. As the principle states: "Honesty and generosity create lasting success, while dishonesty and greed lead to loss and instability."

Hard Work vs. Laziness: The Defining Factor in Financial Success

Tim Borody, CPA, CMA, CFP, Investment Advisor, Advice First Wealth - September 16th, 2025

When it comes to financial success, the biggest difference between those who thrive and those who struggle is their approach to work and responsibility. As the principle states: "Hard work creates stability and success, while laziness leads to struggle and missed opportunities."

The Wealth of Wisdom: Why Smart Financial Choices Matter

Tim Borody, CPA, CMA, CFP, Investment Advisor, Advice First Wealth - July 22, 2025

Building financial success isn’t about luck—it’s about consistently making smart, well-informed choices. As the principle suggests: "Lifelong learning and good judgment lead to success, while impulsive decisions create setbacks."

The Smart Investor’s Mindset: How Wisdom Leads to Financial Success

Tim Borody, CPA, CMA, CFP, Investment Advisor, Advice First Wealth, July 14, 2025

Success in personal finance isn’t about luck—it’s about making informed, thoughtful choices. As the principle suggests: "Seek wisdom, make informed decisions, and prioritize long-term thinking for lasting success."

Having a Financial Plan Matters — Especially When Life Throws You a Curveball

Having a Financial Plan Matters — Especially When Life Throws You a Curveball

Tim Borody, CPA, CMA, CFP, Investment Advisor, Advice First Wealth

Life has a way of surprising us - sometimes in good ways, and sometimes with unexpected costs we didn’t see coming. Recently, I met with clients who found themselves facing exactly that. They’d been doing all the right things: working hard to improve their finances, setting aside money every month for home maintenance and unexpected expenses, and steadily building up their emergency fund.